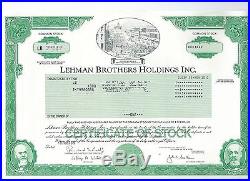

Lehman Brothers stock certificate. This is not a photocopy. It was lithographically printed by Security Columbian_United States Banknote Corporation and American Bank Note Company. Because it is a lithograph, the borders are not intaglio. More info courtesy ofWikipedia. Lehman Brothers Holdings Inc. (former NYSE ticker symbol LEH) /limn/ was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch), doing business in investment banking, equity and fixed-income sales and trading especially U. Treasury securities, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008. In 1844, 23-year-old Henry Lehman, the son of a Jewish cattle merchant, emigrated to the United States from Rimpar, Bavaria. He settled in Montgomery, Alabama, where he opened a dry-goods store, H. In 1847, following the arrival of his brother Emanuel Lehman, the firm became H. ” With the arrival of their youngest brother, Mayer Lehman, in 1850, the firm changed its name again and “Lehman Brothers was founded. During the 1850s, cotton was one of the most important crops in the United States. Within a few years this business grew to become the most significant part of their operation. Following Henry’s death from yellow fever in 1855, the remaining brothers continued to focus on their commodities-trading/brokerage operations. By 1858, the center of cotton trading had shifted from the South to New York City, where factors and commission houses were based. Lehman opened its first branch office at 119 Liberty Street, [16] and 32-year-old Emanuel relocated there to run the office. [13] In 1862, facing difficulties as a result of the Civil War, the firm teamed up with a cotton merchant named John Durr to form Lehman, Durr & Co. [17][18] Following the war the company helped finance Alabama’s reconstruction. The firm also dealt in the emerging market for railroad bonds and entered the financial-advisory business. [16][19] In 1899, it underwrote its first public offering, the preferred and common stock of the International Steam Pump Company. Despite the offering of International Steam, the firm’s real shift from being a commodities house to a house of issue did not begin until 1906. In that year, under Emanuel’s son Philip Lehman, the firm partnered with Goldman, Sachs & Co. [21][22] to bring the General Cigar Co. To market, [23] followed closely by Sears, Roebuck and Company. [23] During the following two decades, almost one hundred new issues were underwritten by Lehman, many times in conjunction with Goldman, Sachs. Among these were F. Woolworth Company, [23][24] May Department Stores Company, Gimbel Brothers, Inc. Macy & Company, [25] The Studebaker Corporation, [24] the B. And Endicott Johnson Corporation. Following Philip Lehman’s retirement in 1925, his son Robert “Bobbie” Lehman took over as head of the firm. During Bobbie’s tenure, the company weathered the capital crisis of the Great Depression by focusing on venture capital while the equities market recovered. Traditionally a family-only partnership, in 1924, John M. Hancock became the first non-family member to join the firm, [21][26] followed by Monroe C. Gutman and Paul Mazur in 1927. By 1928, the firm moved to its now famous One William Street location. [27] It also helped finance the rapidly growing oil industry, including the companies Halliburton and Kerr-McGee. In the 1950s, Lehman underwrote the IPO of Digital Equipment Corporation. Later, it arranged the acquisition of Digital by Compaq. The item “Lehman Brothers stock certificate 2008 Original Genuine Authentic FREE SHIPPING” is in sale since Monday, February 06, 2017. This item is in the category “Coins & Paper Money\Stocks & Bonds, Scripophily\Financial Institutions”. The seller is “antiquestocks*com” and is located in Concord, California. This item can be shipped worldwide.