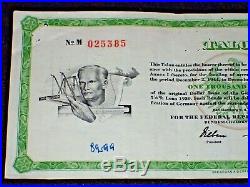

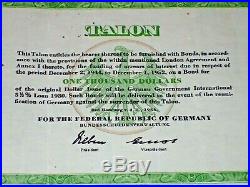

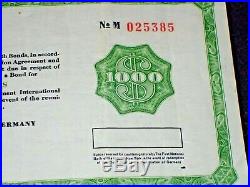

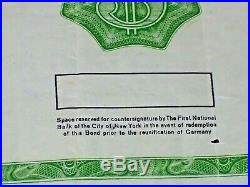

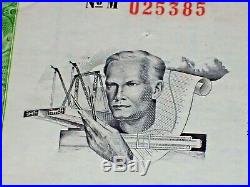

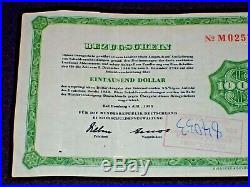

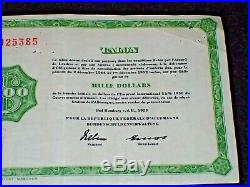

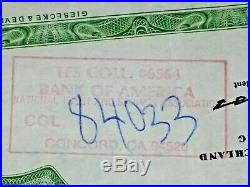

This “Talon” was issued in 1953 in accordance with the London Agreement regarding Germany’s pre-war debt, namely the international “Young Bond” International Issue of 1930. In 1933 Germany defaulted on this series of bonds and it was not until after the war there was a resolution to this matter. Holders of Young Bonds were to send the bond to the Federal German Republic for Certification / Authentication and would subsequently be issued the Talon, as listed. This note was the equivalent bearer bond as the 1930 German International 5 1/2% Loan – the caveat to the issue of the talon was it would only be vested upon the reunification of Germany. In 1995 there was one notice published in the New York Times, it read as follows. The Deutsche Bank Securities Corporation has been retained as a conversion and paying agent for the settlement of accrued interest on four specific prewar bond issues. These are: the 7 percent German External Loan of 1924 (Dawes Loan); the 5 1/2 percent German International Loan of 1930 (Young Loan); the 6 1/2 percent External Sinking Fund Dollar Bonds of the state of Prussia (1926), and the 6 percent External Sinking Fund Dollar Bonds of the state of Prussia (1927). Holders of the rights certificates (Talons, Prussian coupons) for these bond issues should contact the Deutsche Bank Securities Corporation. This Talon remains in uncancalled condition and was never negotiated with Deutsche Bank for redemption. The bond was utilized at one time as. Collateral for a loan as is evidenced by the stamp from Bank of America. I have never seen another one of these Talons and apparently they were nearly impossible to acquire from the German government in the 1950’s. To the very best of my knowledge this is still a legal / negotiable bearer instrument. It remains in overall good condition and does exhibit numerous staple holes as see in the photos. Please review all photos for details regarding the condition of the item listed – further condition information will be included in the listing as is relevant, if you need additional photographs or have questions regarding the condition please do not hesitate to ask. I describe all items to the best of my ability – please do not hesitate to ask any and all questions prior to the close of the listing. Mistakes very rarely occur – however if one does please rest assured that it will be corrected. International Buyers are Welcome! The item “1930 German Young Bond $1000 Bearer Talon Uncancelled 1953 Issue, Negotiable VR” is in sale since Sunday, September 8, 2019. This item is in the category “Coins & Paper Money\Stocks & Bonds, Scripophily\Government & War Bonds”. The seller is “tortugaacquisitions” and is located in Avon, Colorado. This item can be shipped worldwide.

- Country/Region of Manufacture: Germany

- Circulated/Uncirculated: Circulated