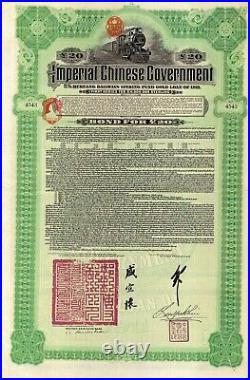

1911 – Imperial Chinese Government, 5% Hukuang Railways Sinking Fund Gold Loan. 21 ¾ x 14 ½. US District Court for the Northern District of Alabama – 550 F. 1982 September 1, 1982, found for the plaintiffs. Trumps New Trade War Tool Might Just Be Antique China Debt. Collectors of pre-Communist debt are lobbying the White House to force Beijing to make good. President Donald Trumps next move in an increasingly fraught trade war with China could be one for the history books, literally. Certificates sell as collectibles. For as little as a few hundred dollars each. Ratcheting up the trade rhetoric. With China, holders of the antiquarian bonds are hoping hell press their case, even as other parts of the U. Treasury Secretary Steven Mnuchin, and U. Commerce Secretary Wilbur Ross have met with bondholders and their representatives. Kirbyjon Caldwell, pastor of a Texas megachurch and spiritual adviser to George W. Bush, has been charged by the U. Caldwell has pleaded innocent and maintains that the bonds are legitimate. With President Trump, its a whole new ballgame, says Jonna Bianco, a Tennessee cattle rancher who leads a group representing pre-revolutionary China bondholders and who has met with the president. Hes an America First’ person. The Hukuang Railway bond is a thing of beauty. The Chinese have another term for it: For them it fits squarely into Chinas Hundred Years of Humiliation, when the Middle Kingdom was forced to agree to unfair foreign control. Soon after the imperial dynasty was overthrown in 1911, the Republic of China began tapping the international capital markets for funding too. Its these bonds that Bianco, who co-founded the American Bondholders Foundation in 2001 to represent holders of pre-communist debt, is hoping could be a useful political leverage in Trumps fight with China. The Peoples Republic of China dismisses its defaulted sovereign obligations as pre-1949 Republic of China debt, but doing so contradicts the PRCs claim that it is sole successor to the ROCs sovereign rights, Bianco said in an emailed statement in response to this story. Bianco says shes spent years researching the issue and recruiting high-profile proponents to the ABF team, including Bill Bennett, who was U. Secretary of Education under Ronald Reagan; Brian Kennedy, senior fellow at the Claremont Institute; and Michael Socarras, Bushs nominee for Air Force general counsel. She argues that China is in selective default, having paid out on bonds held by British investors in 1987 as part of the Hong Kong handover deal negotiated by former Prime Minister and Iron Lady Margaret Thatcher. Whats wrong with paying China with their own paper? She met with Trump at his sprawling golf course in Bedminister, N. Last August, in an encounter she describes as wonderful. Since then shes met with Mnuchin, though she wont reveal what was discussed. ABF reps, including Bennett, Kennedy, and Socarras, met with Commerce Secretary Ross in April, Bianco says. Spokespeople for Treasury and Commerce declined to comment. People familiar with the views of Chinese officials say theyre aware of the meetings, but they dont think the claims can be revived. At issue is a statute of limitations that has long run its course and the fuzzy legal obligations of governments that inherit their predecessors debts following civil upheavals. I think everyone who works for Trump at the Treasury Department thinks this is loony, says Mitu Gulati, law professor at Duke University and a sovereign-debt restructuring expert. But I cant help but be tickled pink, because at a legal level these are perfectly valid debts. However, youve got to get a really clever lawyer to activate them. Clever lawyers have tried before. Gene Theroux, formerly senior counsel at Baker & McKenzie LLP, helped represent the Chinese government in court. Theroux, now retired, remembers the landmark case well. The requests of us as lawyers were occasionally unusual, he says, including China nixing any citation of previous cases with Republic of China in the title, given its refusal to recognize the regime under its One China policy. Eventually, Baker & McKenzie resolved the problem by citing old cases as Republic of China [so-called]. The suit was thrown out on the basis that the 1976 Foreign Sovereign Immunities Act, which allows U. Courts to hear cases against foreign governments for commercial claims, could not be retroactively applied to bonds issued at the turn of the century. Since then, a 2004 Supreme Court decision ruled that the FSIA could apply retroactively in a case immortalized in the movie Woman in Gold. The ruling paved the way for Maria Altmann to reclaim paintings by the famous Austrian artist Gustav Klimt decades after theyd been seized by the Nazis. That still leaves the problem of reactivating modern legal claims on debt that is now decades old. Its a legal long shot, but one that Gulati has assigned to his law students as a theoretical exercise. In a 2018 complaint against Pastor Caldwell and a self-described financial planner named Gregory Alan Smith, the. SEC accused the pair. Some of the buyers, mostly elderly retirees, liquidated their annuities to invest, the SEC said. In a press conference in March, Cogdell said the charges against his client were false. Smith entered a plea agreement to the charges last month. In reality, the bonds were mere collectible memorabilia with no investment value. With Saleha Mosin, Jennifer Jacobs, and Steven Yang. Russell JACKSON, et al. The PEOPLE’S REPUBLIC OF CHINA, a foreign government, Defendant. United States District Court, N. Eugene Rutledge, Birmingham, Ala. No appearance entered for defendant. Plaintiffs filed suit pursuant to the Foreign Sovereign Immunities Act of 1976, 28 U. §§ 1330, 1391 and 1602 et seq. This case is presently before the Court on motion of plaintiffs for default judgment pursuant to Rule 55, F. Historical and Factual Background. With more than 4,000 years of recorded history, China is one of the oldest countries in the world. Its civilization flourished economically and culturally in the earliest stages of world civilization. Until modern times, China’s development had been independent of other countries because of the spirit of its people as well as its geography. Imperial China was born in 221 B. With the institution of the rule of the first emperor of the Ch’in Dynasty. During the rise and fall of the different Chinese dynasties China made great strides in agricultural productivity, cultural development and political unity. The political institutions of imperial China embodied a combination of Confucian Theory (characterized by respect for tradition, conventional social relationships and rule by benevolence) and Legalist practice (characterized by stern laws and severe punishments). In the 16th century, during the Ming dynasty, drastic changes began to take place in China which would have far reaching effects on its insular nature. European explorers arrived in South China, followed by traders and missionaries. The importance of these events is that they heralded an end to China’s isolation and the beginning of East-West contact. China’s preoccupation with tradition and its own cultural superiority made it reluctant to change in the face of western influence. However, its resistance was slowly dissipated, first by the acceptance of western technology. In the early 1900s, in a period known as the Manchu Reform Movement, China embraced modernization in earnest. One of the changes was the construction of a railway system in order to develop the economy, consolidate the defense system and strengthen national unification. The Hukuang Railway was a part of this expanding system. The Imperial Chinese Government 5% Hukuang Railways Sinking Fund Gold Loan of 1911, First of a Series for 6,000,000 Pounds Sterling, each bond denominated in either 20 or 100 Pounds Sterling. 101,151 to 116,120 are countersigned by or on behalf of Messrs. Kuhn, Loeb & Co. The First National Bank of the City of New York, and the National City Bank of New York. The proceeds from the sale of these bonds were used to build the final link in the north-south railway system. This link, the Hukuang Railway, connects Beijing, formerly Peking, and the port city of Canton. Prior to the completion of this railway, goods were transported either over land on poor roads or circuitously by the sea and the Yellow and Yangtze Rivers which run east-west. Consequently, the Hukuang Railway was a major step forward for fast and efficient transportation between north and south. It is still in operation as an integral part of China’s railway system. The 5% Hukuang Railway Bonds provide, among other things, that. The interest on this Bond will be payable on the surrender of the proper coupons hereto annexed. If redeemed the principal of this Bond with premium (if any) will be payable at or after the redemption date, on the surrender of this Bond with all coupons thereon not then due; if not redeemed, the principal will be payable at or after the due date on surrender of this Bond. The First National Bank of the City of New York and the National City Bank of New York, and such other offices in London, Germany, France and New York, respectively, as shall be notified by advertisement by the said respective Banks or Bankers. In 1912, shortly after the Hukuang bonds were issued, a revolutionary movement culminated in the replacement of the Imperial Chinese Government by the Republic of China. The government made timely interest payments on the Hukuang bonds until 872 December 15, 1930. After that date, only two other interest payments were made. These were half interest payments made on June 15, 1937 and June 15, 1938. In the spring of 1937, the government of the Republic of China which was then led by Chiang Kai-shek, offered a compromise program to honor the Hukuang bonds. The government sought to extend the due date on the principal value of the bonds from June 15, 1951 until June 15, 1976. The compromise program was never assented to by the bondholders and was never carried out by the government because of the outbreak of the Sino-Japanese War in July, 1937. The war with Japan continued until it announced its willingness to surrender in 1945. From that point until 1949, China was wracked with the turmoil of a civil war as the Communist Party of China fought to take control of mainland China. On August 13, 1947, the prime minister of the national government issued the following statement relative to the Hukuang bonds. China pledges her honourable intention to repay those external loans the service of which was suspended in the course of the Sino-Japanese war. In no way does the conclusion of new loans in recent years prejudice the security of these pre-war loans or vitiate the rights of holders of such bonds. At the same time, China hopes soon to start a progressive programme of debt rehabilitation in accordance with the policy of upholding the national credit. Like so many other postwar nations today, China will yet need international economic assistance to rehabilitate her trade and industry so as to strengthen her ability to make debt payments. Nevertheless, the National Government is determined to do its best to fulfill its obligations and sincerely hopes that financial conditions will soon show sufficient improvement to enable it to make arrangements for an early resumption of the service of pre-war loans. The Communist party seized control of China in 1949 and established the People’s Republic of China. The former national government withdrew to Taiwan. It is an established principle of international law that [c]hanges in the government or the internal policy of a state do not as a rule affect its position in international law. A monarchy may be transformed into a republic, or a republic into a monarchy; absolute principles may be substituted for constitutional, or the reverse; but, though the government changes, the nation remains, with rights and obligations unimpaired. State of Russia, 21 F. 2d 396, 401 2d Cir. 1927 quoting Moore, Digest International Law, vol. The People’s Republic of China is the successor government to the Imperial Chinese Government and, therefore, the successor to its obligations. § 1330(a), this Court has subject matter jurisdiction without regard to the amount in controversy over any nonjury civil action against a foreign state, agency or instrumentality as to any claim for relief with respect to which the foreign state or agency is not entitled to immunity. The People’s Republic of China is a foreign state within the meaning of the Immunities Act and is not entitled to immunity from suit by virtue of 28 U. § 1605(a), which provides as follows. (a) A foreign state shall not be immune from the jurisdiction of courts of the United States or of the States in any case. (2) in which the action is based upon a commercial activity carried on in the United States by the foreign state; or upon an act performed in the United States in connection with a commercial activity of the foreign state elsewhere; or upon an act outside the territory of the United States in connection with a commercial activity of the foreign state elsewhere and that act causes a direct effect in the United States… A “commercial activity carried on in the United States by a foreign state” is defined as a commercial activity carried on by such state and having substantial contact with the United States. It is clear that the sale, issuance for sale and authorization of issuance for sale in the United States constitutes a “commercial activity” carried on in the United States by a foreign state. 2d 270 3rd Cir. Imperial Iranian Air Force. Therefore, the defendant is not entitled to the general immunity granted to foreign states under 28 U. § 1604 with respect to the bonds which are the basis of this suit. Having established subject matter jurisdiction, this Court may exercise jurisdiction over the defendant provided service of process is made in strict compliance with 28 U. Service was made upon the People’s Republic of China pursuant to 28 U. § 1608(a) (4) which states that. Indicating when the papers were transmitted. The Office of Special Consular Services sent to the Clerk of this Court a certified copy of the diplomatic note indicating that the summons, complaint and notice of suit were transmitted to the Embassy of the People’s Republic of China in Washington, D. On May 16, 1980. Service is deemed to have been made as of the date of transmittal. On October 22, 1981, this Court certified this action as a class action consisting of all persons who, on the date of the order, were holders of the Hukuang Railway bonds which are the basis of this suit. On the same date, the Court found that the People’s Republic of China had failed to appear or to answer plaintiffs’ complaint within the time allowed by law and that the time for answering or appearing had expired. Accordingly, a default was entered against the defendant and in favor of the plaintiff class. The Court ordered plaintiffs’ lead counsel, W. Copies of the orders certifying this as a class action and entering a default were served upon the Embassy of the People’s Republic of China in the same manner as the summons, complaint and notice 874 of suit were served. Section 1608(e) provides that no default judgment shall be entered against a foreign state unless the claimant establishes his claim or right to relief by evidence satisfactory to the court. This is the same rule that applies to entry of default judgments against the United States. By its order of October 22, 1981, this Court, on the basis of plaintiffs’ motion, brief and testimony, found that the People’s Republic of China failed to appear or plead within the requisite time and was, therefore, in default. The defendant received notice of this order by “notice of entry of default” on December 10, 1981. At the same time, the defendants were advised that they had sixty days after receipt of the documents within which to ask the Court to set the default aside. Rule 55(c), F. Does not set a specific time for setting aside a default. However, courts have held that the moving party must act with reasonable promptness. Consolidated Masonry & Fireproofing, Inc. 2d 249 4th Cir. 1967 (two and one-half months was not reasonably prompt). Under the circumstances, the plaintiff class is entitled to and this Court has the authority to enter a judgment of default against the People’s Republic of China. The only issue remaining then is the determination of plaintiffs’ damages. A hearing was held before this Court on March 29, 1982, to determine the amount of damages. Expert testimony was presented to the Court concerning the method by which calculations should be made to determine the amounts due in unpaid principal and interest. A calculation table prepared by the expert witness who testified at the hearing of this case is attached to this Memorandum Opinion as Exhibit A. A separate order embodying these conclusions shall issue. The item “1911 Imperial Chinese Government, 5% Hukuang Railways” is in sale since Tuesday, December 8, 2020. This item is in the category “Coins & Paper Money\Stocks & Bonds, Scripophily\Other Scripophily”. The seller is “66tom65″ and is located in New York, New York. This item can be shipped to United States, China, Germany, Canada, United Kingdom, Denmark, Romania, Slovakia, Bulgaria, Czech republic, Finland, Hungary, Latvia, Lithuania, Malta, Estonia, Australia, Greece, Portugal, Cyprus, Slovenia, Sweden, Indonesia, Thailand, Belgium, France, Hong Kong, Ireland, Netherlands, Poland, Spain, Italy, Austria, Bahamas, Israel, Mexico, New Zealand, Philippines, Singapore, Switzerland, Norway, Saudi arabia, Ukraine, United arab emirates, Qatar, Bahrain, Croatia, Malaysia, Colombia, Costa rica, Dominican republic, Panama, Trinidad and tobago, Guatemala, Honduras, Antigua and barbuda, Aruba, Belize, Dominica, Grenada, Saint kitts and nevis, Saint lucia, Montserrat, Turks and caicos islands, Barbados, Bangladesh, Bermuda, Brunei darussalam, Bolivia, Ecuador, Egypt, French guiana, Guernsey, Gibraltar, Guadeloupe, Iceland, Jersey, Jordan, Cambodia, Cayman islands, Liechtenstein, Sri lanka, Luxembourg, Monaco, Macao, Martinique, Maldives, Nicaragua, Oman, Peru, Pakistan, Paraguay, Reunion, Viet nam, Uruguay, Russian federation.